Corporate Accounting Short Notes For BCOM Sem II

Corporate accounting

Prof. Haney-“A company is an artificial person created by law, having separate entity with perpetual succession and a common seal”.

Companies Registered under Companies Act, 2013—

1. Unlimited Company – A company not having any limit on the liability of its members is called an unlimited company. It is not found in India even though permitted by Act.

2. Company Limited by Guarantee – Each member is

liable to contribute the amount

guaranteed by him to be paid in the event of the winding up of the company.

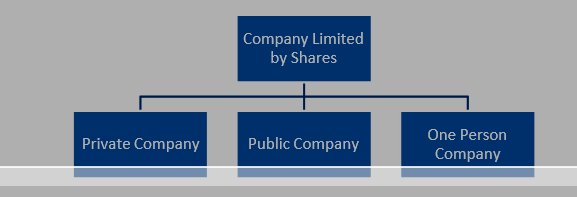

3. Company Limited by Shares – Each member is

liable to pay the full nominal value of shares held by him.

|

Private Company |

Public Company |

|

1. Section 2(68) |

1. Section 2(71) |

|

2. Members- Minimum

-2 Maximum - 200 |

2. Members – Minimum -7 Maximum – No Limit |

|

3. It Can’t

issue prospectus to inviting public |

3. It issues

prospectus inviting to public |

|

4. Shares can’t

transferred |

4.Shares can be freely

transferred |

|

5. Compulsory to use the word Pvt. Ltd.

at the end Of name |

5.Compulsory to use the word Limited at the

end of name |

|

6. Mandatory to prepare their AOA |

6.Not mandatory to prepare their AOA |

|

7. Not required to hold statutory meeting |

7.Required to hold statutory meeting within six month of getting the certificate |

|

|

commencement. |

|

8. A private

company can start

its business just after incorporation |

8.A

public company can start its business after getting the

letter of commencement of business |

|

9. Shares

can’t be quoted

in the stock market |

9.Shares are quoted in the stock market |

|

10. Minimum 2 directors are mandatory |

10.Minimum 3 directors are mandory |

|

11.No restriction on managerial remuneration |

11. Managerial remuneration cannot exceed

11% of net profit |

·

Section 2(62)

One Person

Company

·

Private limited company

·

One person

member

·

Natural and Resident

·

Minimum paid up capital ₹1 lakh

·

Directors –

1 to

15

·

No requirement of cash flow statement

·

An OPC can convert into Private Limited Company or Public Limited

Company, when –

1. Two year has expired

2. Paid-up capital

increased beyond ₹50 Lakh or

3.

Average annual turnover

exceeds ₹ 2 crore

Shares

Ø Share is the small denomination of capital of company

Ø

Movable property

Ø Transferrable as per Articles

of Association(AOA)

Ø

Treated as goods under Sale of Goods Act, 1930

Ø These can be bought, sold, hypothecated, bequeathed

Types of Share – Under Section 43 of Companies Act, 2013

1. Equity Shares

2. Preference Shares

Preference Shares-

Ø Preference shares are paid dividend before payment of equity share capital

Ø Preference shares are paid capital at the time of winding up before payment of equity share capital

Ø Preference shareholders have limited voting

right

Ø

Rate of dividend

on preference shares is predetermined

Ø It can be

converted into equity share

Ø

The risk is lower

Ø Cumulative preference shares get arrears

Ø

No control over management

Ø It can be redeem

Equity Shares-

Ø Real owner of the firm

Ø

Get dividend in return

Ø Enjoy full voting right

Ø Right to participate in management

Ø It cannot convert into preference share

Ø Maximum risk

Ø

Rate of

dividend is not fixed

Ø No right

of arrears of dividend

Ø It cannot redeem

Right Shares-

Ø

Shares for existing shareholders

Ø Object of issue of this

shares is to increase subscribed capital

Ø Right shares

must be in the ratio of

equity shares of the

existing shareholders

Ø

Regulated by

Section

81 of the Companies Act

Ø These shares

can be renounced by a member in favour

of his nominee

Bonus Shares-

Ø When company paid bonus in the form of shares is called bonus shares

Ø These are issued to existing shareholders free of cost

Ø No minimum subscription is required

Ø It is also called capitalisation of profit

Ø Bonus shares are always fully paid up

Deferred Shares-

Ø

Issued to founders or promoters of the company

Ø Rate of dividend is not fixed

Ø Dividend is paid at the last (after payment to equity and preference shares)

Ø

No Public Company can issue deferred shares

Ø Deferred shares are not a common source of

equity

Ø Highest risk

Ø These shares

are also called Founder shares

or Management shares

Sweat Equity Shares-

Ø Sec. 54 of Companies Act 2013

Ø Issued to employees or Directors at discount or for

consideration other than cash

Ø For making available Intellectual Property Right

(IPR)

Ø Lock-in-period – 3 years

Blue Chip Shares-

Ø Shares of companies with large market

capitalization

Ø Continuously growing value of shares

Ø

Blue chip Companies are leaders in their field

Ø Lower risk due to financially stable

company

Employee Stock Option Plan (ESOP)--

Ø Employee benefit

scheme

Ø Issue to employees, directors,

officers at a rate considerably lesser than the prevailing market rate

Ø

Section 62(1)(b) of the Companies Act, 2013

Ø Passed resolution at general meeting

Ø The options

cannot be pledged,

hypothecated, mortgaged or otherwise alienated in any respect

Ø Lock-in-period – 1 year

According to Section 55 of the Companies Act 2013, no company limited by shares shall issue any Preference Share which is irredeemable or redeemable after

the expiry of 20 years.

Types of Capital-

1. Authorised Capital

or Maximum Capital

or Nominal Capital

or Registered Capital

– stated in MOA

2. Issued Capital

3. Subscribed Capital

4.

Called up

Capital – called by directors from shareholders

5. Paid up Capital

6.

Reserve Capital

7. Fixed Capital

8. Working Capital

Reserve Capital

– As per Sec.65 of Companies Act 2013, only an unlimited

company having a share capital while converting into limited company may

have reserve capital.

Difference between Reserve

Capital and Capital

Reserve

|

Reserve Capital |

Capital Reserve |

|

1. Not necessary to create |

1. Necessary to create |

|

2. A resolution is required to create |

2. No resolution is required to create |

|

2. Not shown in Balance Sheet |

3. Shown

in Balance Sheet |

|

4. Used at the time

of winding up |

4.Used to write off capital loss |

Private Placement of Shares-

Ø Sec. 42 of the Companies Act 2013

Ø Used by Public Company

Ø Issued to Promoters, Friends, Relatives, Shareholders of group of Companies, Mutual

Funds, NRIs, FIs (LIC, GIC, UTI,

ICICI) etc.

Ø Need not issued prospectus

Ø Prepare a draft prospectus known as ‘Statement in Lieu of Prospectus’

Ø Lock-in period – 3 years

Public Subscription of Shares— by a Public Company

1.

To issue Prospectus – prospectus is an invitation to public

2. To Receive

Applications - should not less than 25% of issue

price

3.

To Make Allotment

of Shares –

Ø Companies Act 2013 has not prescribed the minimum

subscription

Ø

According to SEBI guidelines – minimum subscription is 90%

Ø As per Sec. 39(3)

of company has to get minimum subscription within 30 days from the date of issue,

otherwise returned within next 15 days.

If there will be delay in refunding

amount, interest will be charged

@ 15% per annum

4. To Make Calls

– Calls must be made according

to AOA

Point to Remember –

Ø Amount on application, allotment

and calls should not exceed 25% of issue price

Ø From the date of allotment, all calls should be made within a period of 12 months

Ø There should

be a gap of at least one month between two

calls

Ø At least 14 days notice to pay calls

Prohibition on Issue of Shares at Discount—

Sec. 53 of Companies

Act 2013 –

Ø

No permission to issue

of share at discount

Ø Only Sweat Equity

Shares are issued at discount Issue of Shares to Promoters:

Incorporation Cost or Formation

Exp.................. Dr.

To Share Capital A/c

Issue of Shares to Vendors:

A.

When assets are purchased—

Sundry Assets A/c................................ Dr.

To Vendor’s A/c

B. When shares are issued to Vendors:

Vendor’s A/c........................................... Dr.

To Share Capital A/c

As per Table F of Schedule

I of Companies Act 2013—

A. Interest on calls in Arrears – 10% per annum

Interest on call in Advance – 12% per annum

Forfeiture of Shares –

Ø Cancel the shares when shareholders unable to pay amount on calls on due date

Ø Forfeiture is allowed only when AOA permit

Ø 14 days prior notice given to pay otherwise it will cancel

Ø Share Capital

A/c (called up amount)......... Dr.

To Calls in Arrears

A/c (unpaid amount)

To Share Forfeiture A/c (paid amount)

Ø After forfeiting the shares, company

may re-issue the shares and balance will transfer to

Capital Reserve Account.

Ø Nature of Share Application Account is Personal Account

Question 1- Y Ltd. forfeited 400 shares of ₹10 each, ₹7 called up, for non- payment

of first call of ₹2 per share. Out of these, 300 shares were reissued for

₹6 per share

as ₹7 paid up. What is the amount to be transferred to Capital Reserve

A/c. Ans. ₹1200

Question 2- X

Ltd. forfeited 500 shares of ₹10 each, ₹8called-up on which Vikash has paid application and allotment money

of ₹6per share. Of these, 400 shares were

re-issued to Ravi as fully paid for ₹9 per share. Amount transferred to Capital

Reserve??? Ans. ₹₹2000

Debentures

Ø Debenture is a certificate of loan

Ø It represents borrowing capital of the

firm

Ø

Debenture holders get interest in return

Ø Rate of interest is fixed

Ø

Debenture holders do not

have any voting right and power in

management

Ø Debenture holders

are creditors of the firm

Ø No company is

allowed to issue debenture having a maturity date of more than

10 years but in case of infrastructure company, it should be more than 10 years but not exceeding 30 years

Ø

Specified rate of interest – Coupon rate

Ø A bond without rate of interest

is deep discount bonds or zero coupon

bonds.

Types of Debentures:

1.

Redeemable and Irredeemable Debenture

2.

Convertible and Non-convertible Debenture

3.

Secured and Unsecured Debenture

4.

Registered and Bearer Debenture

5.

Fixed and Floating

Debenture

6.

Callable, Puttable, Subordinated and Participating Debentures

Source of Finance for Redemption of Debenture-

1.

By fresh issue

of share or debenture

2.

Out of Capital

3.

Out of

Profits

Ø Creation of Debenture Redemption Reserve (DRR) is obligatory only for non-convertible debenture

Ø A company

shall create DRR equivalent to at least 25% of the amount

of debentures issued

Ø Exemption from creating

DRR –

v

All India Financial Institutions regulated by RBI

v

Other Financial Institutions regulated by RBI

v

Banking Company

v

Housing Finance Company

registered with National

Housing Bank.

Ø When all debentures have been redeem – Debenture

Redemption Reserve (DRR)

A/c is closed by

transferring the amount

to General Reserve Account

Ø As per Rule 18(7)(C) of Companies

Rule, 2014 – every company

required to created

DRR and invest not less

than 15%

Methods of Redemption of Debentures—

1. By lump sum method

2.

By instalment

3. By purchase

of own debentures in open market

4. By conversion into shares

Comments